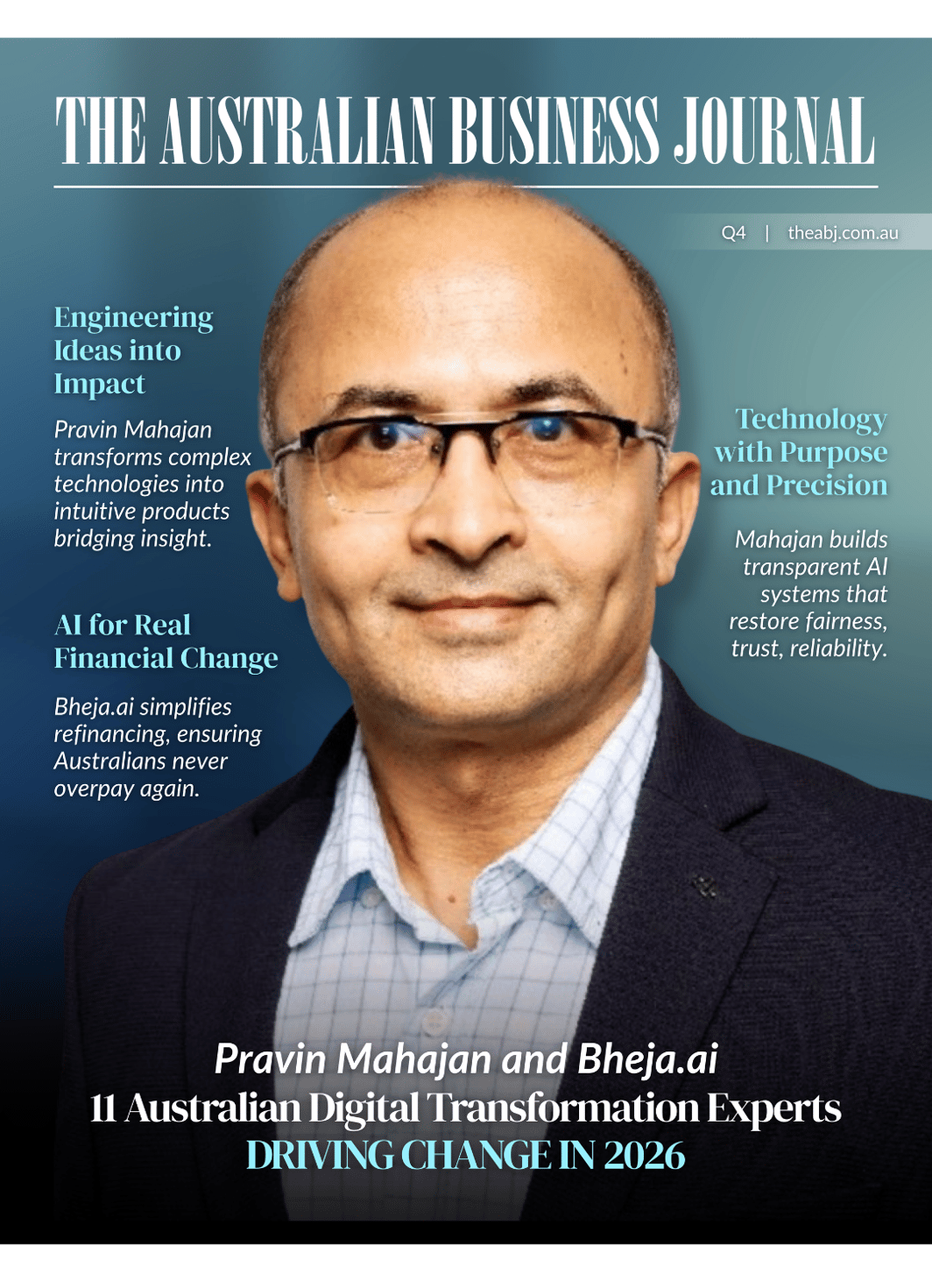

Pravin Mahajan

Former CTO @ RateCity & CIMET • Solutions Architect at Lasoo (Salmat ) & Woolworths

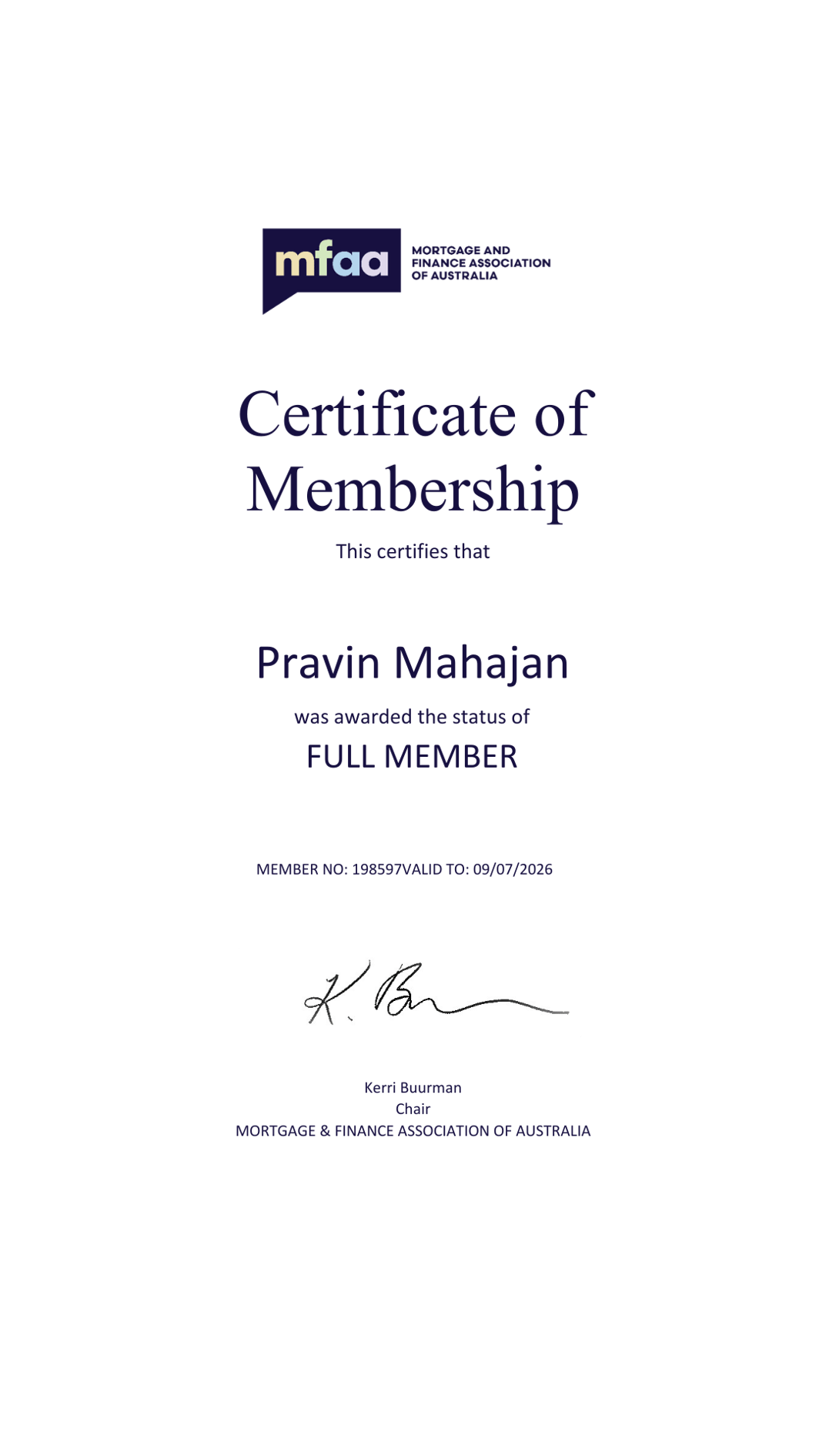

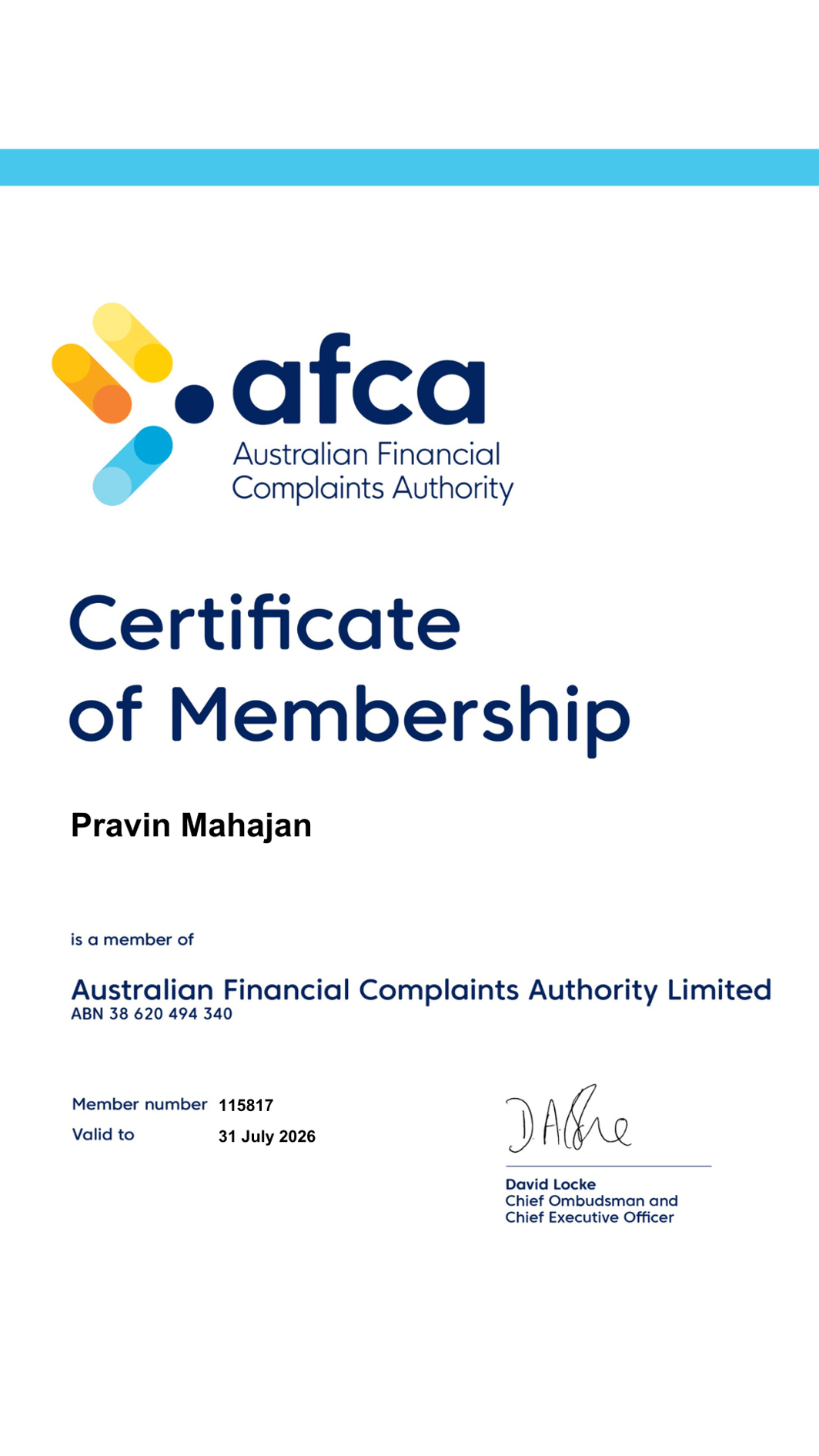

Pravin Mahajan is the Founder of Bheja.ai and an accredited Mortgage Broker (Credit Representative 570637). Based in Sydney, he operates at the intersection of financial regulation, artificial intelligence, and enterprise-scale technology, a combination that uniquely positions him as a trusted voice in Australia’s home loan and property finance space.

With more than three decades of experience, Pravin has built, scaled, and led some of Australia’s most influential financial comparison ecosystems. The systems he architected have supported millions of Australians in making informed home loan, energy, broadband, and retail purchasing decisions.

Career Highlights (Australia-Focused)

RateCity (Acquired by Canstar)

Chief Product & Technology Officer

Pravin led RateCity’s technical transformation, built market-first comparison infrastructure, and orchestrated Australia’s First Home Loan Sale, a nationwide campaign that reached over 12 million Australians. His leadership contributed directly to RateCity’s successful acquisition by Canstar.

CIMET

Chief Product & Technology Officer

He built enterprise-grade comparison technology powering energy and broadband switching across major B2B partners, enabling millions of plan comparisons and high-speed customer onboarding.

Salmat / Lasoo

Solutions Architect

Architected Australia’s leading digital catalogue platform with 5.7 million monthly users, digitising retail experiences for brands such as Target, Myer, and Woolworths.

Woolworths Group

Designed the secure real-time Pay at Pump transaction engine rolled out nationwide, still recognised as one of the best examples of frictionless retail payments in Australia.

Current Focus: Bheja.ai: AI for Responsible Lending

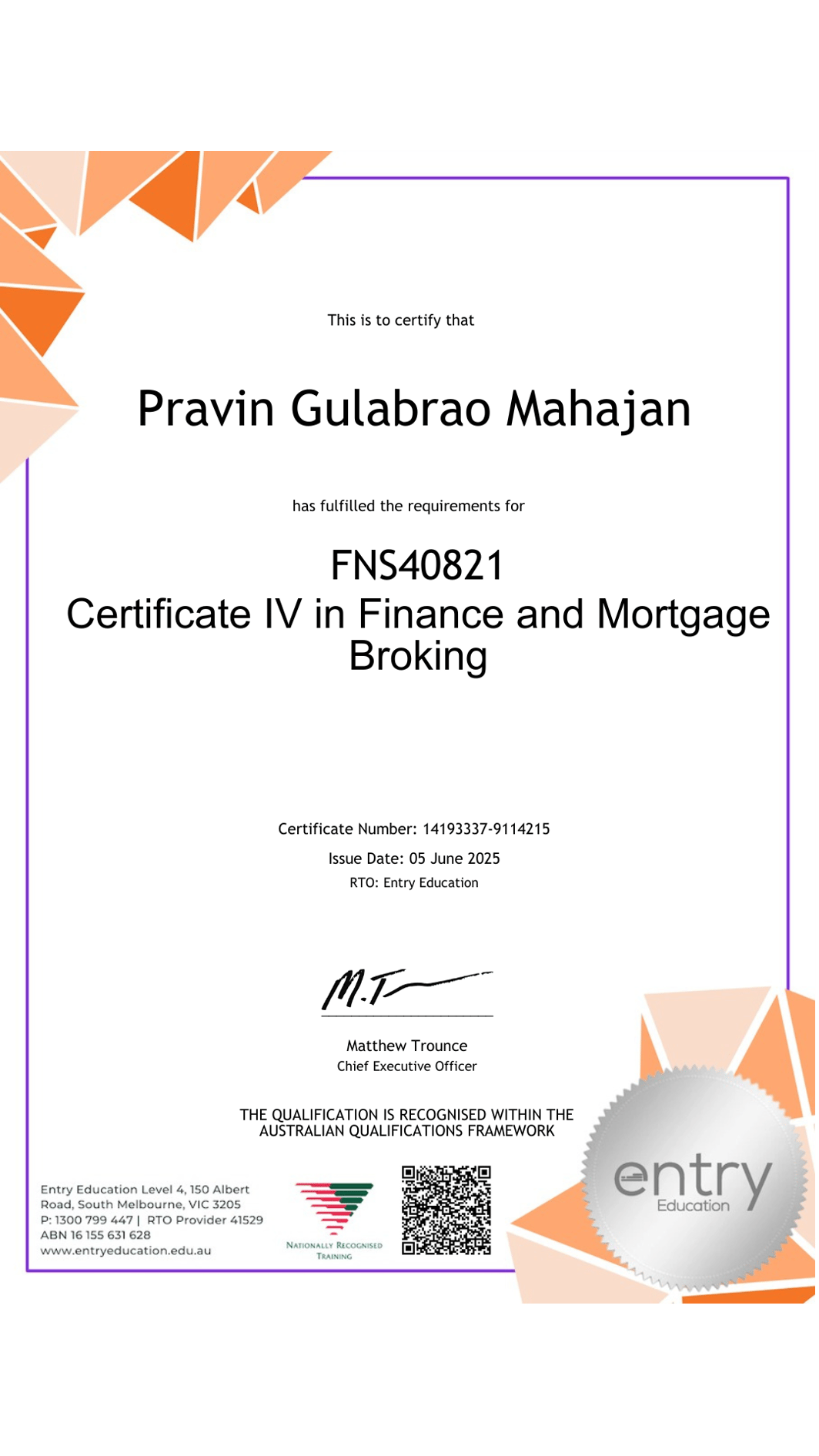

Today, Pravin brings together Certificate IV in Finance & Mortgage Broking, deep lending policy knowledge, and decades of enterprise engineering experience to build AI-driven mortgage and financial guidance systems at Bheja.ai.

He specialises in:

- Home loan selection & refinancing

- Borrowing capacity modelling

- RBA rate impact forecasting

- First-home buyer strategy

- Lender policy optimisation

- Digital workflows for brokers and lending teams

His vision is simple:

Empower Australians to make smarter financial decisions with transparent, data-backed insights.