Home Loan Health Check

Wondering if your home loan is still the right one for you?

With interest rates constantly changing, your mortgage might be costing you more than it should.

Tell us about your loan

Home loan health check Australia: Is your home loan working for you?

For most Australians, a home loan is their biggest financial commitment. But after the excitement of moving in, it often becomes something people stop thinking about—just another direct debit each month.

But ignoring your mortgage can be costly. Many homeowners end up paying a "loyalty tax," where existing customers are charged higher interest rates than new ones, sometimes up to 0.5% more.

In today’s times of rising costs, every dollar saved on your home loan makes a difference. A simple review of your mortgage could help uncover better rates or features and help you save more than you might expect.

Research shows that homeowners, on average, save approximately $1,524 annually just by refinancing. For many, that's a family holiday, a significant boost to the kids' school fees, or a much-needed top-up to the savings account.

Why your mortgage needs a regular check-up

A mortgage is a long-term commitment, but it should not be a set-and-forget arrangement. The mortgage market changes rapidly, and a loan that was ideal a few years ago may no longer be the best option for you.

Many mortgage experts recommend that you review your home loan at least once a year. Check how your mortgage stacks up agains what's available on the market. Are you throwing away your hard earned money by being a loyal customer? Do you still need all the features you are paying for?

How often should you review your mortgage?

- At least once every year.

- When you experience significant life changes, such as a change in your income, having a baby, moving to a larger home or approaching retirement. Make sure to check if your mortgage still meets your needs.

- When the cash rate changes.

- If the fixed-rate period on your mortgage is ending.

Automate your home loan health check with Bheja.ai

We make your home loan work harder for you, helping you save time and money for things you enjoy.

- AI-powered insights: Our system automatically monitors your loan and alerts you when a better rate becomes available.

- Broker-backed support: Connect with an accredited mortgage expert only if you choose to.

- No cost, no credit impact: 100% free tool designed to put you in control.

- Built for Australian borrowers: Whether you’re in Sydney, Melbourne, or Brisbane, we help you stay mortgage-smart.

The health check process: A step-by-step guide

So, what does a home loan review involve? It’s a simple process that gives you the information you need to make a good decision.

Scrutinising your loan: What to look for

- Start by checking your current interest rate against what’s available in the market. Even a small rate drop can lead to big savings over time.

- Review ongoing fees, package costs, or restrictions that might be eating into your savings. Make sure your loan features, like an offset account or redraw facility, are being used and adding value.

- If your financial situation has changed, such as higher income, better credit, or more equity, you may qualify for a sharper deal.

Regularly reviewing these details helps ensure your home loan works for you, not the other way around.

What next?

If you think you're not the best possible deal, you could pick up the phone and ask your lender to move you to a better rate. But do your homework by checking what other lenders are offering borrowers in your situation. If your bank doesn't budge, you can always consider switching. Many lenders reserve their best rates for new customers. Some may also offer cashback on refinance home loans to help offset your refinancing costs.

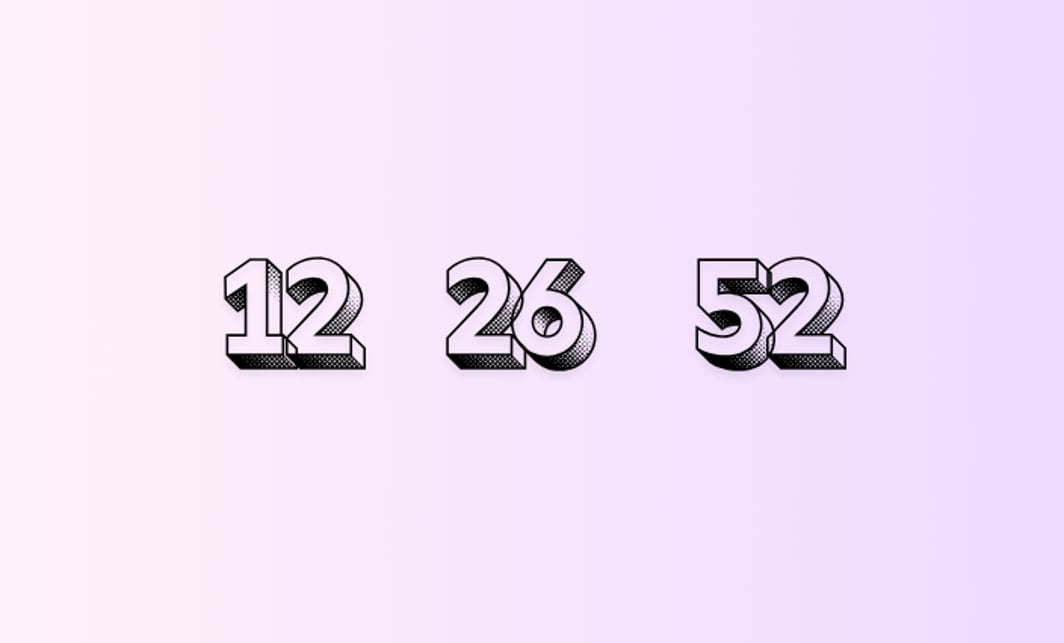

Even if your mortgage is still right for you. Bheja.ai can suggest simple ways to save money, such as paying fortnightly instead of monthly.

Pro tip: Switching lenders isn't always free.

You should be aware of potential costs, including application fees, valuation fees, and settlement fees. If you're on a fixed rate, there could also be substantial break fees. A thorough mortgage review will calculate these costs and weigh them against the potential long-term savings to provide a clear break-even point.

A general rule of thumb is that refinancing is worth considering if you can secure a rate at least 0.5% below your current one.

Title: Case Study: Renegotiate or Refinance?

Scenario: An Adelaide family with a $600,000 loan balance and 25 years remaining. Their current variable rate is 6.25%.

Note: This is an illustrative example. Actual savings, rates, and costs will vary based on individual circumstances, you can try the calculator at the top of this page or just Ask Bheja.

The feedback so far has been strong, even from experienced finance experts:

"I can’t believe it's going to drop 4 to 5 years off the loan term." - Asset finance Cofounder.

"The simplicity and hack for switching repayments is awesome." - Big Four loan officer with 15+ years.

"Shocked to see the amount of savings." - business analyst at a major bank.

Read more details about why we built health check calculator.

Getting professional help: Brokers vs. lenders.

You can conduct a basic health check on your own, but seeking professional help can make a significant difference in your overall financial well-being. You can either go straight to a lender or use a mortgage broker.

Using a mortgage broker: Mortgage brokers are now the top choice for many Australians, helping with almost 75% of new home loans in 2024. Here’s why they’re a good option:

- Choice: A broker has access to a panel of dozens of lenders, including majors and non-majors, whereas your bank can only offer its own products.

- Expertise: They are experts at navigating the complexities of different loan products and policies.

- Best Interests Duty: Since 2021, brokers have been legally obligated to act in their clients' best interests. This Best Interests Duty provides a crucial layer of consumer protection, ensuring the advice you receive is tailored to your benefit, not the broker's commission.

On average, homeowners who use a broker for refinancing can achieve an interest rate reduction of 0.3% to 0.5%, resulting in substantial savings.

Going direct to your lender: Your current bank wants to keep your business. If you consider refinancing, they may have special teams who can offer you a better rate. Banks are also utilising new technology to streamline the review process and maintain customer satisfaction.

However, going direct means you're only seeing one set of products. You won't know if a better deal exists elsewhere unless you've done the research yourself or engaged a broker.

Frequently Asked Questions

It’s a quick review of your current mortgage to see if you’re still on a competitive rate based on today’s market.

Take the next step

so you can save money and find the best home loan that fits your needs.

Learn. Compare. Decide.

Mortgage Broker vs Bank: What is better for you?

Best Bank for Home Loan in Australia: The Complete 2026 Guide

DTI Rules 2026: Why ADI vs Non-ADI lenders could save (or cost) you $100,000

The Ultimate Mortgage Checklist: Every Question to Ask Your Broker (2026 Edition)

Is it better to pay your mortgage monthly, fortnightly, or weekly in Australia?