Quick Verdict: Broker or Bank?

Most Australians choose a mortgage broker when applying for a home loan. A broker can be a better option if you want access to a wide range of lenders, need help with complex income (such as self-employment), or simply prefer someone to negotiate rates for you.

Going directly to a bank can still work well if your finances are straightforward, you have a strong deposit, or you’re happy to stick with your existing bank for convenience.

If you’re looking for a home loan in Australia, you’ll need to decide whether to work with a mortgage broker or go straight to a bank. This guide explains the main benefits and drawbacks of each option. The right choice depends on your situation, goals, and the kind of support you want during the process.

What is a mortgage broker and what do they do?

A mortgage broker is a licensed professional who sits between you and the lenders. Their job is to understand your financial situation, work out how much you can borrow, and then compare home loans from a wide range of banks and non-bank lenders.

They help explain your options, prepare your paperwork, lodge your application, and guide you through to approval or refinancing. Brokers are paid by the lender, not you, and must legally act in your best interests under ASIC rules.

If you want to double-check a broker’s credentials, you can look them up on ASIC’s professional register or through industry bodies like the MFAA or the FBAA.

What is a bank and what do they do?

A bank is a financial institution that lends money directly to borrowers. When you apply with a bank, you’re dealing with their own staff, their own credit policies, and their own range of home loan products.

The bank handles everything in-house — from assessing your application to approving, servicing, and managing the loan over time. The main limitation is choice: you only see the products offered by that particular bank.

Is it easier to get a home loan through a mortgage broker?

For many borrowers, yes. But it often comes down to personal preference and how much support you want during the process.

Why a broker can feel easier:

- Wider choice of lenders

Brokers compare loans from a panel of banks and non-banks, giving you access to far more options than you’d find on your own. - Less legwork

They do the heavy lifting, running borrowing-power checks, comparing rates, preparing paperwork, and managing the application from start to finish. - Help with tricky situations

If you’re self-employed, on contract work, or have multiple income sources, a broker usually knows which lenders are more flexible.

When a bank might feel easier:

If your financial situation is simple and you want to stay with your existing bank for convenience, going direct can sometimes be quicker, especially for refinancing.

Is it cheaper to get a home loan through a mortgage broker?

Using a mortgage broker usually doesn’t cost you anything. In Australia, brokers rarely charge a fee for their service. Instead, they’re paid a commission by the lender once your loan settles.

A broker’s payment doesn’t change your interest rate or add extra fees to your loan. Lenders pay the same commission across the industry, so brokers aren’t rewarded for steering you toward more expensive loans.

The overall cost of your home loan depends on the product you choose: the interest rate, fees, and features. A broker may help you get a better rate by comparing lenders and negotiating for you, but your savings depend on the deal itself, not the channel you use.

In short, brokers don’t usually charge you directly, but the cheapest option is always the loan with the most competitive pricing and features for your situation.

Pros and Cons of using a mortgage broker

Pros:

- Access to a wide range of lenders and home loan products

- Expert guidance tailored to your financial situation

- Can save you time by handling comparisons and paperwork

- May negotiate better rates or terms on your behalf

- Brokers are typically free to borrowers (paid by the lender)

Cons:

- Brokers don’t have access to every lender or loan on the market

- Recommendations may be limited to their panel of lenders

- Potential for bias due to commission-based compensation

Pros and Cons of going directly to a bank

Pros:

- Direct access to the lender’s full range of products and specials

- You may be able to use your existing relationship to negotiate a better deal

- A single point of contact, which can make the process feel more straightforward

Cons:

- Limited to the bank’s own loan options

- You must do all research, comparisons, and negotiations yourself

- May miss out on competitive offers from other lenders

What are the key takeaways for borrowers comparing mortgage brokers and banks?

When should you choose a mortgage broker?

A broker can be the better option when you want more support or when your situation isn’t straightforward. You may prefer a broker if you:

- Want access to multiple lenders instead of checking each bank yourself

- Are buying your first home and need help with grants, schemes, and deposit rules

- Have complex income (contracting, self-employed, variable hours, bonuses or overtime)

- Need someone to negotiate rates and policy exceptions on your behalf

- Don’t have time to manage paperwork or compare products

- Want a smoother refinancing process with less back-and-forth

A broker can reduce the risk of applying with the wrong lender and facing delays or declines.

When should you go directly to a bank?

Going straight to a bank may make sense if your finances are simple and you prefer staying with a familiar institution. A bank could be suitable if you:

- Already have accounts with the bank and want everything in one place

- Have a strong income history and a standard PAYG job

- Are refinancing and want the fastest possible approval

- Prefer to manage the application yourself without a third party

- Only want to consider your current bank’s products

This path works best for borrowers who value speed and simplicity over choice.

Case studies: Broker vs bank; what would you choose?

Scenario 1: The "First-Time" Navigator

Target Audience: Users searching for "help buying first home Australia"

Scenario 2: The "Complex Income" Earner

Target Audience: Users searching for "home loan for contractors" or "self-employed mortgage"

Scenario 3: The "Loyal" Refinancer

Target Audience: Users searching for "fastest home loan approval"

What should you know about mortgage brokers and banks in Australia?

What is the current state of the Australian home loan market?

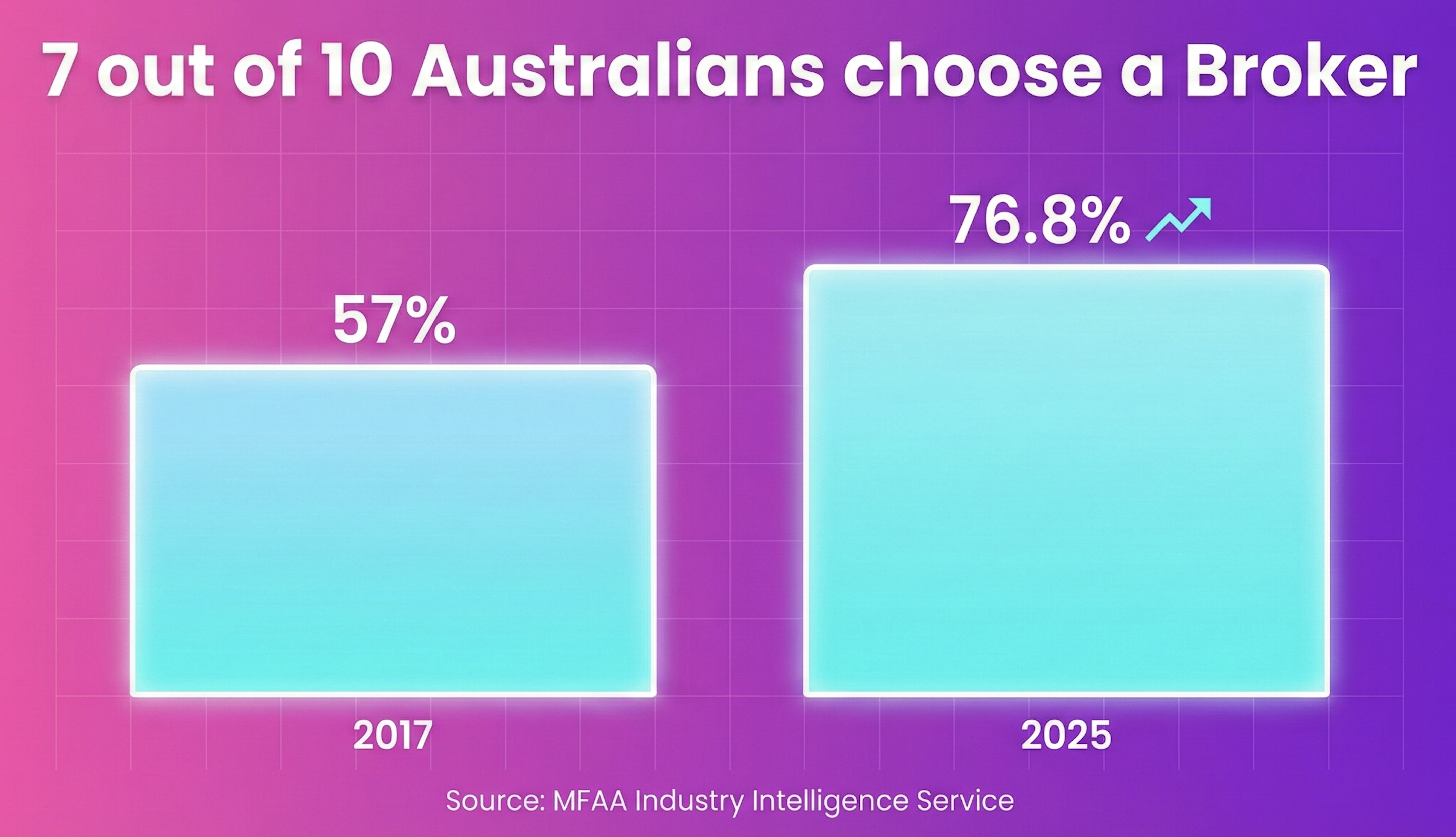

The Australian home loan market continues to see mortgage brokers dominate, accounting for about 76.8% of all new residential home loans in the March 2025 quarter—up from roughly 74.1% a year earlier and significantly higher than 57% in 2017.

This reflects the ongoing, growing influence of brokers in connecting borrowers with a wide range of lenders, including both banks and non-bank financial institutions. Understanding the strengths of mortgage brokers can help if you’re looking to compare home loans in Australia.

Brokers are handling increasing volumes: in the March 2025 quarter alone, brokers settled AU$99.37 billion in new home loans, a nearly 22% increase year-on-year. While banks remain the main sources of funds, an increasing number of loans are being accessed via brokers. The “big four” banks (Commonwealth Bank, NAB, ANZ, Westpac) still hold a large share of the home lending market directly, accounting for approximately 70–75% of outstanding loan value. However, small and medium banks, as well as non-bank lenders, are now relying heavily on the broker channel for new originations.

Individual bank disclosures (for example, Macquarie) indicate that a very high proportion, often 90–95%, of new loans from these lenders are broker-originated, even if exact splits for all medium banks aren’t always published.

The "Safety Net" Law: Why brokers are safer?

Since January 1, 2021, a federal law known as the Best Interests Duty (BID) applies only to Mortgage Brokers, not Banks.

- Mortgage Brokers: Must legally prioritise your financial interests above their own commissions. If a lender pays a higher commission but offers a worse rate, the broker cannot recommend it.

- Banks: Are not bound by this duty. They can (and do) sell you their own products even if a competitor offers a better deal.

The Verdict: When you use a broker, you have a legal safety net that bank customers do not.

Brokers also give you access to a wider range of lenders, which reduces the risk of taking a loan that isn’t well suited to your situation. For people with complex income or limited experience, this can make the process easier and more transparent.

That said, going directly to a bank is also safe. Banks are heavily regulated and familiar to most borrowers. The difference is simply that banks promote their own products, while a broker compares a range of options for you.

What disclosure requirements apply to mortgage brokers?

Mortgage brokers in Australia are required to comply with ASIC's Regulatory Guide 273, which mandates acting in the best interests of consumers and fully disclosing all fees, commissions, and any potential conflicts of interest.

Since 2021, brokers cannot rely solely on consumer consent to disclosures; they must ensure transparency and clear communication about the remuneration they receive from lenders.

Most brokers do not charge direct fees to consumers; instead, they earn commissions from lenders. However, disclosure of these commissions is compulsory to maintain consumer trust and ensure regulatory compliance.

What regulatory protections and dispute resolution options are available to borrowers?

Consumers who believe brokers or banks have breached their obligations can seek recourse through the Australian Financial Complaints Authority (AFCA), which handles disputes related to fee disclosure and breaches of the best interests duty.

ASIC enforces compliance through investigations and penalties, exemplified by significant fines imposed on firms for misleading conduct and inadequate fee disclosure.

Consumer protections are further supported by the National Credit Act and Australian Consumer Law, providing avenues for legal remedies in cases of mis-selling or unconscionable conduct.

These protections ensure that consumers can confidently navigate the mortgage market, with mechanisms in place to address grievances.

How do interest rates, fees, and costs compare between brokers and banks?

Interest rates don’t usually change based on whether you apply through a broker or directly with a bank. They depend on the lender, your situation, and the loan product itself.

Where brokers often add value is choice and negotiation. With access to a wide panel of lenders, brokers can compare multiple options, spot sharper deals, and request discretionary discounts that you may not receive by approaching a bank on your own.

A challenge for borrowers is that home-loan pricing in Australia isn’t always transparent. Banks frequently use discretionary pricing—case-by-case discounts that aren’t advertised—making it hard to compare whether a bank’s direct offer is truly better than what you could get via a broker.

Recent Reserve Bank data shows new owner-occupier rates averaging around 5.83% p.a. in early 2025, with some easing after cash rate cuts. Both brokers and banks can access rates in this range, but the difference lies in how widely you search.

In short: brokers generally make it easier to find competitive pricing because they compare across lenders, while banks can only offer their own products. The “better” option depends on the lender, the discount available, and your personal financial profile.

Is refinancing more cost-effective with a broker or a bank?

Refinancing is a crucial consideration for existing homeowners seeking more favourable rates or loan terms. Mortgage brokers are well-positioned to assist in this process as they have access to a broader range of lenders, including non-bank lenders funded through securitisation. This expanded access often results in more competitive refinancing options than those offered directly by banks.

Although banks have responded to recent cash rate increases by offering competitive retention and loyalty rates to existing customers, the overall competition for refinancing has softened. This environment gives brokers an edge in uncovering better deals tailored to borrowers’ specific circumstances.

While brokers earn commissions from lenders for their services, these costs are unlikely to affect borrowers. Consequently, many Australian homeowners find broker-assisted refinancing to be a cost-effective strategy for optimising their mortgage over time.

How do digital platforms shape the customer experience for mortgage brokers and banks?

What is the quality and impact of online mortgage broker platforms?

Online mortgage broker platforms have become critical tools for borrowers. Reviews indicate that brokers have leveraged digital channels effectively, contributing to their rising market share of 71.7% in late 2022 and to 76.8% as of the MFAA.

These platforms often feature user-friendly interfaces, competitive loan offers with cashback incentives, and tools for comparing loan products, enhancing borrower convenience and transparency. However, regulatory scrutiny underscores the need for secure, compliant digital environments, which is reflected in consumer trust and satisfaction.

How do processing times and approval rates compare between brokers and banks?

Processing times and approval rates vary between brokers and banks. Brokers help reduce borrower confusion around mortgage products, aiding smoother applications. However, broker platforms sometimes face challenges with communication, technology reliability, and processing speed.

Banks benefit from regulated, secure digital portals and the introduction of government-backed digital identity frameworks, which enhance application efficiency and the reliability of approval.

Recent surveys indicate that borrower satisfaction with brokers' application processes has declined, indicating the need for brokers to enhance their digital infrastructure and communication.

Overall, banks may have an edge in processing speed and certainty of approval, but brokers offer valuable advisory support and access to a wider range of lenders.

Frequently asked questions

Yes, using a mortgage broker in Australia is highly safe and regulated.

In fact, since January 1, 2021, it is arguably "safer" than going directly to a bank due to a federal law called the Best Interests Duty (BID).

Here is why you are protected:

- The "Best Interests Duty" (BID): Unlike bank employees, mortgage brokers are legally required to act in your best interests. They cannot recommend a loan just because it pays them a higher commission. If a cheaper or better loan exists for your situation, they must offer it. Bank staff do not have this legal obligation; they act in the best interests of their employer (the bank).

- ASIC Regulation: All reputable brokers must hold (or be authorized under) an Australian Credit Licence (ACL) issued by ASIC. This ensures they are qualified, trained, and insured.

- Dispute Resolution: Brokers must belong to an external dispute resolution scheme (like AFCA). If something goes wrong, you have an independent body to turn to for free.

💡 Pro Tip: Always ask your broker for their Credit Guide before you start. This document confirms their license number and outlines how they are paid, ensuring 100% transparency.