The Signal: Banks Move First

In mid-January 2026, well before the RBA's February meeting, Australia's largest lenders sent a clear message: they were pricing in rate hikes ahead. Commonwealth Bank led the charge on January 15, lifting its 3-year fixed rate by a massive 0.70% (70 basis points)—from 5.34% to 6.04%. This single move was equivalent to three standard RBA hikes.

CBA wasn't alone. By early February, more than 30 lenders had repriced fixed products, with Macquarie Bank hiking twice in six weeks. Then, on February 3, 2026, the RBA confirmed what the banks had anticipated: a 25-basis-point increase in the cash rate to 3.85%.

While variable rates rose in lockstep with the RBA's 0.25% increase, the fixed-rate market had already moved with triple the intensity—a clear indicator that lenders expect more hikes ahead.

Track the Impact: Live Lender Response

We're maintaining a live RBA Rate Tracker showing exactly which banks have passed on the February rate hike—and by how much. While most major lenders have matched the RBA's 25bp increase, some have moved faster than others:

Variable Rate Pass-Through:

- CBA, NAB, ANZ: Variable rates increased 0.25% p.a., effective February 13

- Westpac: Variable rates increased 0.25% p.a., effective February 17

- Macquarie: Delayed pass-through until February 20

Fixed Rate Movements (January-February 2026):

- CBA: 3-year fixed +0.70% (Jan 15)

- Macquarie: Multiple hikes totalling +0.50% (Jan-Feb)

- 30+ lenders: Various fixed rate increases ranging from 0.30% to 0.70%

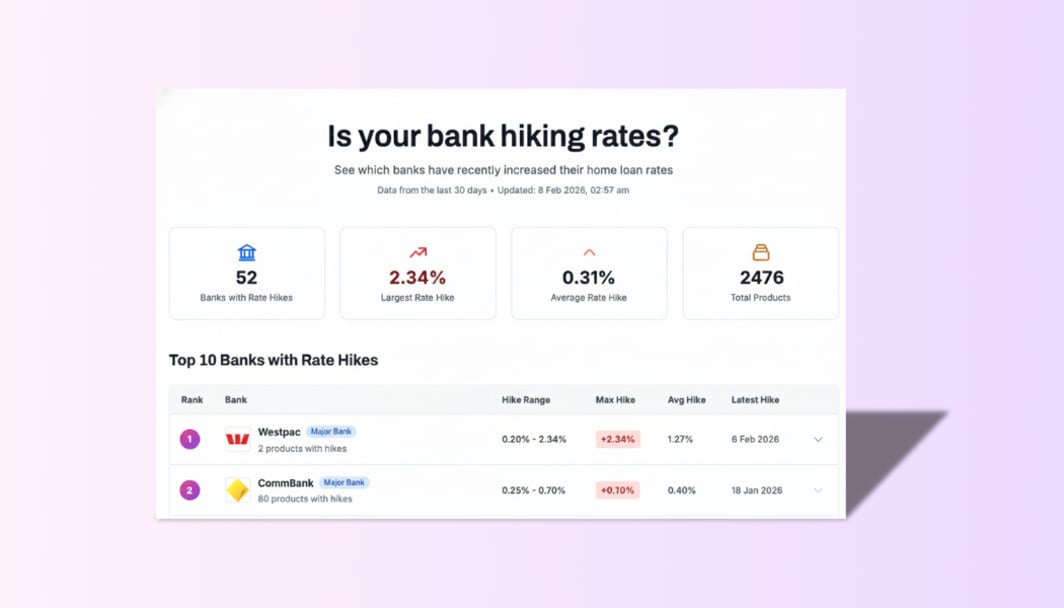

Banks Passing on Rate Changes

See which banks have recently changed their home loan rates

Data from the last 30 days • Updated: 8 Feb 2026, 04:47 am

Banks with Rate Hikes

Largest Rate Hike

Average Rate Hike

Total Products

Top 20 Banks with Rate Hikes

| Rank | Bank | Hike Range | Max Hike | Avg Hike | Latest Hike | |

|---|---|---|---|---|---|---|

1 |  WestpacMajor Bank 2 products with hikes | 0.20% - 2.34% | +2.34% | 1.27% | 6 Feb 2026 | |

2 |  CommBankMajor Bank 80 products with hikes | 0.25% - 0.70% | +0.70% | 0.40% | 18 Jan 2026 | |

3 |  MyState BankMajor Bank 5 products with hikes | 0.15% - 0.60% | +0.60% | 0.34% | 6 Feb 2026 | |

4 |  NATIONAL AUSTRALIA BANKMajor Bank 65 products with hikes | 0.10% - 0.60% | +0.60% | 0.33% | 28 Jan 2026 | |

5 |  MOVE BankMajor Bank 15 products with hikes | 0.30% - 0.55% | +0.55% | 0.41% | 4 Feb 2026 | |

6 |  AMP - My AMPMajor Bank 128 products with hikes | 0.25% - 0.55% | +0.55% | 0.34% | 6 Feb 2026 | |

7 |  BankwestMajor Bank 35 products with hikes | 0.20% - 0.50% | +0.50% | 0.40% | 6 Feb 2026 | |

8 |  Bank of Queensland LimitedMajor Bank 63 products with hikes | 0.25% - 0.40% | +0.40% | 0.34% | 6 Feb 2026 | |

9 |  ME BankMajor Bank 188 products with hikes | 0.25% - 0.40% | +0.40% | 0.33% | 7 Feb 2026 | |

10 |  Bendigo BankMajor Bank 170 products with hikes | 0.20% - 0.36% | +0.36% | 0.24% | 5 Feb 2026 | |

11 |  Macquarie Bank LimitedMajor Bank 100 products with hikes | 0.25% | +0.25% | 0.25% | 15 Jan 2026 | |

12 |  Gateway BankCommunity Owned 2 products with hikes | 0.30% - 0.87% | +0.87% | 0.58% | 6 Feb 2026 | |

13 |  P&N BankCommunity Owned 36 products with hikes | 0.05% - 0.66% | +0.66% | 0.26% | 5 Feb 2026 | |

14 |  Defence BankCommunity Owned 20 products with hikes | 0.35% - 0.65% | +0.65% | 0.51% | 5 Feb 2026 | |

15 |  G&C Mutual BankCommunity Owned 39 products with hikes | 0.20% - 0.60% | +0.60% | 0.31% | 6 Feb 2026 | |

16 |  Beyond Bank AustraliaCommunity Owned 19 products with hikes | 0.25% - 0.50% | +0.50% | 0.35% | 28 Jan 2026 | |

17 |  Australian Military BankCommunity Owned 28 products with hikes | 0.05% - 0.50% | +0.50% | 0.14% | 14 Jan 2026 | |

18 |  CommFCUCommunity Owned 42 products with hikes | 0.25% - 0.45% | +0.45% | 0.37% | 6 Feb 2026 | |

19 |  Queensland Country BankCommunity Owned 31 products with hikes | 0.10% - 0.40% | +0.40% | 0.16% | 29 Jan 2026 | |

20 |  Summerland BankCommunity Owned 30 products with hikes | 0.15% - 0.40% | +0.40% | 0.26% | 6 Feb 2026 |

Data sourced from 6,368 home loan product variations

Showing 2,461 products with rate hikes in the last 30 days

Use our tracker to see if your lender has announced changes, and compare how quickly they're passing on cuts versus hikes. The pattern reveals a lot about which banks prioritise shareholder margins over customer outcomes.

Timeline: How We Got Here

Understanding the sequence of events helps explain why fixed rates moved so aggressively:

January 15, 2026

CBA increases 3-year fixed rates by 70bps (5.34% → 6.04%)

January 28, 2026

December CPI data released: 3.8% annual inflation (above RBA's 2-3% target)

January 15-31, 2026

30+ lenders reprice fixed products; Macquarie hikes twice

February 3, 2026

RBA raises cash rate by 25bps to 3.85%

February 13-20, 2026

Variable rate increases take effect across major lenders

What the Market is Pricing In

Major banks are divided on what comes next:

- NAB: Forecasts another 25bp hike in May 2026

- Westpac & ANZ: Expect the cash rate to hold at current levels

- Market consensus: Uncertainty remains, but the era of falling rates is definitively over

The disagreement reflects genuine uncertainty about inflation persistence versus economic slowdown, but one thing is clear: lenders are protecting their margins by moving fixed rates preemptively.

The Mechanics: Why "Fixed" Is Getting Friction

Here's what most borrowers don't understand: Lenders don't fund fixed loans from the RBA cash rate—they use the Swap Market (wholesale borrowing costs).

The Math:

If a bank expects the cash rate to be 4.5% in 12 months, they cannot offer you a 5.5% fixed rate today without losing money later. The swap market reflects expectations of future cash rates, and those expectations have shifted dramatically.

The Buffer Impact:

This surge in fixed rates creates what we call a "Serviceability Shadow." Even if you aren't on a fixed rate, banks often use the higher of the "Fixed" or "Variable" rate as the floor for their stress tests.

What this means: The 70bps jump in fixed rates may effectively reduce your borrowing capacity, particularly if you're applying for a new loan or seeking pre-approval.

The Action Plan: Your 48-Hour Checklist

1. The "Pre-Approval" Audit

Critical: If you have a pre-approval based on last month's fixed rates, it may be void or significantly reduced.

Action: Call your broker TODAY to refresh your "Max Purchase Price" before heading to an auction. Many buyers are discovering at the last minute that their borrowing capacity has shrunk.

2. Break-Cost Analysis

Who this affects: Anyone currently on a high variable rate (7% or higher).

The window is closing to lock in a sub-6% fixed rate. Have your lender calculate the "break cost" versus the potential savings of a 2-year fix at current rates.

Example calculation:

- Current variable rate: 7.25%

- Available 2-year fixed: 5.99%

- Potential saving: 1.26% p.a.

- On a $500K loan: ~$6,300/year in interest savings

- Break cost to exit variable: Calculate and compare

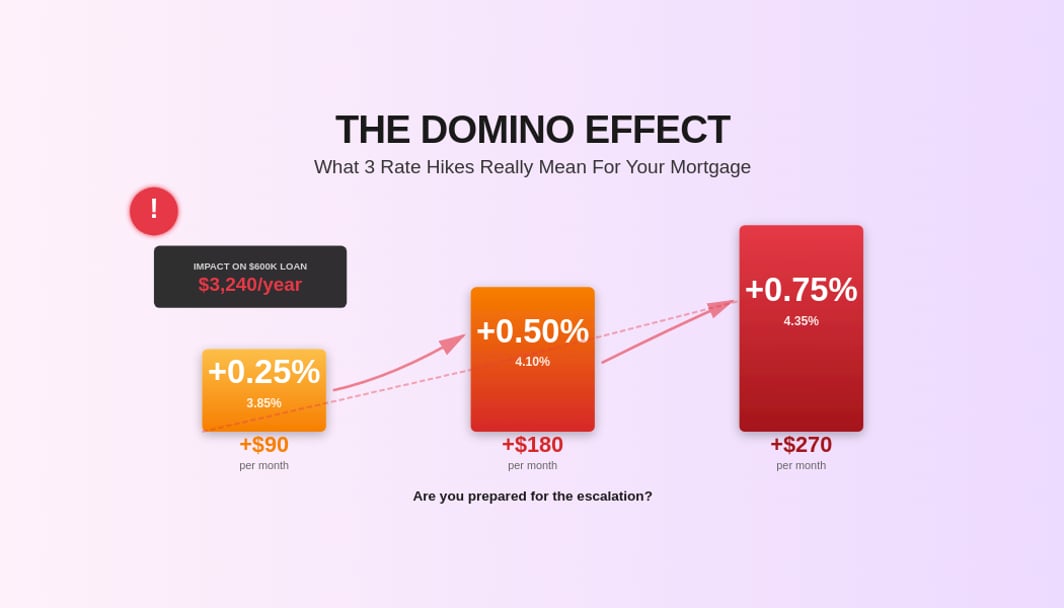

3. The "2026 Cliff" Check

Who this affects: Anyone whose current fixed term expires anytime in 2026.

Do not wait. You need to model a "Transition Offset" strategy now—essentially "over-saving" into an offset account today to cushion the 2% jump you'll likely face upon expiry.

If your fixed rate expires:

- Q1 2026: Revert rate likely 7.0-7.5%

- Q2-Q4 2026: Revert rate potentially 7.5-8.0% if further hikes occur

Check our home loans product search to see what interest rates your bank is currently offering.

The Bheja.ai Solution

Our AI engine has been updated with the latest February 2026 swap rates and RBA expectations. Use the Bheja.ai Refinance Simulator to run a "Fixed vs. Variable" scenario tailored to your situation.

What it calculates:

- Exactly how many RBA hikes it would it take for a variable loan to become more expensive than today's available fixed rates

- Your break-even point for fixing vs. staying variable

- Projected total interest costs under different rate scenarios

- Optimal refinancing timing based on your current loan structure

The Bigger Picture: What This Tells Us About 2026

The aggressive repricing of fixed rates—particularly CBA's 70bp move—reveals what banks' risk models are saying: more hikes are coming, or at the very least, rates will stay higher for longer than initially expected.

Key signals:

- Lenders moved 3 weeks before the RBA decision (not after)

- Fixed rates moved 3x harder than variable rates (forward-looking pricing)

- 30+ lenders acted simultaneously (market-wide consensus)

- Major banks disagree on next move (genuine uncertainty, not coordinated messaging)

What to watch:

- March CPI data (released late April): If inflation remains above 3.5%, May hike probability increases

- Fixed rate trajectory: If 3-year fixed rates cross 6.5%, the market is pricing in 4.5%+ cash rate

- Swap market movements: Leading indicator for where fixed rates will go next

Bottom Line

The 70bps fixed rate surge isn't about what happened on February 3—it's about what banks expect to happen between now and December 2026. Whether you're fixing, staying variable, or refinancing, the key is to act with current information, not last month's assumptions.