Australian Home Loans for Visa Holders & New Migrants

Don't let your visa status limit your borrowing power. Bheja.ai connects you with lenders who understand the nuances of Subclass 189, 190, 482, and more.

Moving to Australia is hard enough without the banking system making it harder. Many "Big 4" banks and generic comparison sites treat all non-citizens as high-risk borrowers. They often require larger deposits, charge higher interest rates, or simply say "no" because their automated systems don't understand your visa.

Bheja.ai is different. We use AI to match your specific residency status and income profile with lenders who specialise in migrant mortgages.

Select Your Visa Status

Find your visa subclass below to see your specific lending rules, LVR limits, and "gotchas."

Permanent Residents (Subclass 189, 190, 200s)

- Eligibility Status: Full Access (Same as Citizen).

- Max LVR: Up to 95% (5% Deposit).

- Government Grants: Eligible for First Home Owner Grant (FHOG) and Stamp Duty concessions.

- FIRB Requirement: None.

- How Bheja.ai Helps: Standard banks often require 3-6 months of Australian employment history. Bheja.ai identifies lenders who accept your overseas employment history to cover any local gaps, allowing you to buy immediately upon arrival.

Temporary Skilled Workers (Subclass 482, 494)

- Eligibility Status: Eligible with Conditions.

- Max LVR: Standard 80% (20% Deposit). High-income earners may qualify for 90% LVR.

- Visa Validity Rule: Most lenders require 12+ months remaining on the visa.

- FIRB Requirement: Yes (Approval required for established homes).

- How Bheja.ai Helps: If you have less than 12 months on your visa, Bheja.ai matches you with specific lenders who accept 6 months remaining, provided you have a stable employment history.

Regional Skilled Visas (Subclass 491)

- Eligibility Status: Eligible (Location Restricted).

- Max LVR: 80% - 90% depending on profession.

- Risk Factor: Property must be located in a "Designated Regional Area" to comply with visa terms.

- How Bheja.ai Helps: Bheja.ai’s location logic ensures you only apply for properties that match both your Subclass 491 visa conditions and the lender's postcode restrictions, preventing compliance errors.

Partner & Spousal Visas (Subclass 820/801 & 309/100)

- Eligibility Status: High Eligibility (Joint Application).

- Max LVR: Up to 95% when buying jointly with an Australian Citizen or PR.

- Stamp Duty: Joint purchases may be exempt from "Foreign Buyer Surcharge" in specific states (NSW, VIC, QLD rules vary).

- How Bheja.ai Helps: We structure your application to leverage the citizen partner’s status, often allowing the couple to avoid the higher interest rates typically charged to temporary residents.

New Zealand Citizens (Subclass 444)

- Eligibility Status: Treated as Permanent Resident.

- Max LVR: 95% (Eligible for Home Guarantee Scheme).

- FIRB Requirement: None.

- How Bheja.ai Helps: Bheja.ai filters out lenders who mistakenly categorize NZ citizens as "foreign investors," ensuring you access local resident interest rates.

Graduates (Subclass 485)

- Eligibility Status: Restricted / High Risk.

- Max LVR: Strict 80% (20% Deposit).

- Risk Factor: Short visa duration and limited employment history often lead to rejection.

- How Bheja.ai Helps: Bheja.ai builds your case based on "Future Employability" (e.g., degrees in Engineering, IT, Nursing) rather than past history, connecting you with lenders who support early-career professionals.

Why generic lenders reject migrants (And How Bheja Fixes It)

Most comparison sites show you a table of rates that you might not actually qualify for. At Bheja.ai, we focus on the "Hidden Technical Barriers" that stop migrants from getting approved.

1. We Solve "Foreign Income Shading"

If you earn income in a foreign currency (USD, GBP, EUR, INR) or have only recently started your Australian job, most banks will "shade" your income. This means they automatically discount your earnings by 20% to 40% to account for currency fluctuations, drastically reducing how much you can borrow.

The Bheja Solution: We identify lenders who apply minimal shading or accept 100% of your base foreign income, maximising your borrowing capacity.

2. No Australian Credit History? No Problem.

A major pain point for new arrivals is the "Credit Score Paradox"—you need a loan to build credit, but you need credit to get a loan.

The Bheja Solution: We work with lenders who use Alternative Data. Instead of a local credit score, they can assess your application based on overseas banking history, regular rent payments, or employment stability.

3. Visa Validity Constraints

Many banks automatically decline applicants with less than 12 months remaining on their visa.

The Bheja Solution: Our AI filters for lenders who accept applicants with as little as 6 months remaining, provided you can show a history of employment in your field.

Ready to find a broker who speaks your language?

Don't let a generic algorithm reject you. Discover your true borrowing power with Bheja.ai.

FIRB Approval: The Simple Guide

The Foreign Investment Review Board (FIRB) regulates who can buy Australian real estate. Understanding where you fit is critical before you make an offer.

Note: FIRB rules change frequently. Use the Bheja Eligibility Checker to confirm your status.

Borrowing Power by Visa Type (LVR Table)

Loan-to-Value Ratio (LVR) represents the percentage of the property price a bank will lend you.

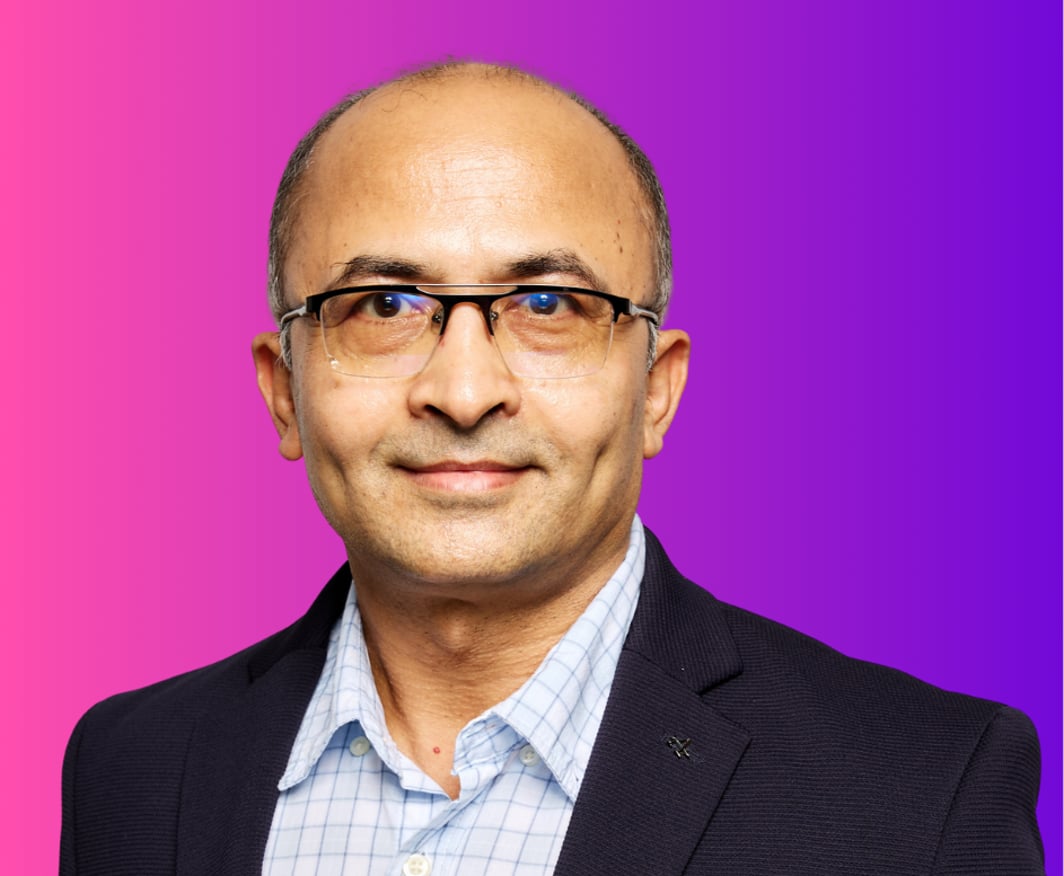

Pravin Mahajan

Founder @ Bheja.ai | Mortgage Broker | Ex-CTO RateCity & CIMET

Pravin Mahajan is the Founder of Bheja.ai and an accredited Mortgage Broker (Credit Rep. 570637). Based in Sydney, he sits at the unique intersection of financial regulation and enterprise technology.

With over 30 years of experience, Pravin has architected the consumer platforms that millions of Australians rely on for daily financial and purchasing decisions. His career is defined by building high-scale systems that simplify complex choices:

- RateCity (Acquired by Canstar): As Chief Product & Technology Officer, Pravin led the tech transformation that culminated in the company's acquisition. He orchestrated "Australia’s First Home Loan Sale," a digital initiative that reached over 12 million people.

- CIMET: As CPTO, he built enterprise-grade infrastructure for energy and broadband comparison, scaling operations to support major B2B partners.

- Salmat (Lasoo): He architected digital catalogue systems used by 5.7 million monthly users, digitising the retail experience for brands like Target and Myer.

- Woolworths: Designed the real-time, secure "Pay at Pump" transaction infrastructure deployed Australia-wide.

Today, at Bheja.ai, Pravin combines this deep technical background with his Certificate IV in Finance and Mortgage Broking to build AI agents that don't just compare loans, but help Australians actively secure their financial future.

Frequently Asked Questions

Generally, you must be a Permanent Resident or Citizen to qualify for the FHOG. However, if you are buying jointly with a partner who is a PR/Citizen, you may still be eligible for stamp duty concessions or grants depending on the state.