Buying a home can feel daunting, especially when saving for a deposit seems impossible. Zero deposit home loans make it easier for Australians to get onto the property ladder without the hefty upfront costs. In this article, we’ll explore what these loans are, who can apply for them, and how you can navigate the application process effectively.

Key Takeaways

- Zero deposit home loans let you buy a house without needing a large upfront cash deposit, making homeownership more accessible.

- Eligibility for these loans mainly focuses on income stability and sometimes credit history, so check with lenders for specific requirements.

- These loans can come with higher interest rates, increasing overall costs in the long run, so weigh your options carefully.

- Gather important documents like proof of income, expenses, and identification to streamline your application process.

- At Bheja.ai, we help you navigate home loans with AI-driven insights. You can compare over 100 brands, get proactive alerts, and make smarter financial decisions effortlessly.

Zero Deposit Home Loans Explained: What They Are and How They Work

Zero deposit home loans, also known as no deposit home loans, are financial options that allow potential homebuyers to purchase a property without needing to provide any upfront cash as a deposit. This loan type is designed primarily for those who may struggle to save the standard 20% deposit that is often required for a house purchase.

These loans are particularly appealing to first-time buyers or those looking to transition into home ownership without significant savings. With a zero deposit mortgage, the total amount of the property is financed, meaning buyers can move into their new homes sooner rather than later.

So, how do they work? Built on the same structure as traditional mortgages, zero deposit loans involve obtaining the full loan amount needed to purchase a property. While this is great for those who don't have the savings, bear in mind that lenders will often require private mortgage insurance (PMI) or lender's mortgage insurance (LMI) to protect themselves against potential default, given the increased risk they take on.

Eligibility Requirements for These Loans

Like any financial product, zero deposit loans come with specific eligibility criteria. Understanding these can ensure you prepare effectively to apply.

Income Thresholds

- Consistent Income: Lenders usually want to see a stable income source. This may include your salary, bonuses, or other forms of regular income.

- Debt-to-Income Ratio: Most lenders assess your debt-to-income ratio to ensure you can afford the loan. A lower ratio indicates more disposable income, which may make you an ideal candidate.

- Good Credit Score: A strong credit history is commonly a requirement for securing a zero deposit loan. Aim for a score above 620 for better chances.

Applicant Types

- First-time Homebuyers: Many first-time buyers look for zero deposit loans to help them enter the market without significant savings.

- Low-Income Applicants: If you’re within prescribed income limits, certain loans may be available to assist you.

- Existing Homeowners: Those looking to upgrade or switch properties may also qualify, depending on their specific financial situation.

Pros and Cons of Zero Deposit Loans

Every financial decision comes with its positives and negatives. Here’s a look at the pros and cons of zero deposit loans.

Benefits

- Lower Upfront Costs: The primary advantage is that you can buy a home without saving for a deposit, making it easier to enter the property market.

- Quicker Access to Property: Not needing a deposit means you can purchase sooner, which is beneficial in competitive markets.

- Tax Benefits: Like any homeowner, you may be eligible for tax deductions on the interest paid on your mortgage.

Risks

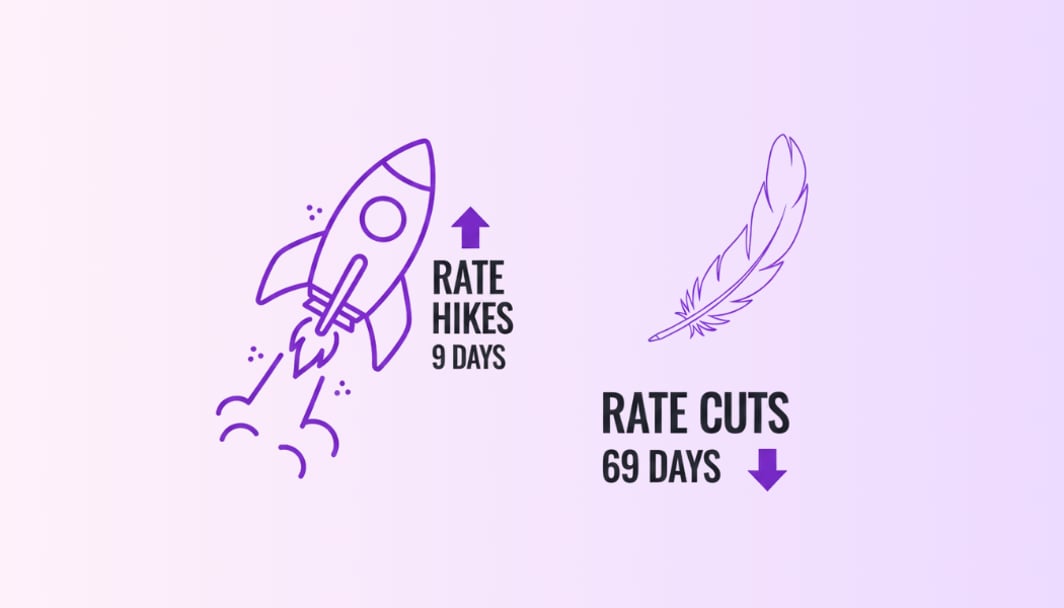

- Higher Interest Rates: Because you're considered a higher-risk borrower, expect less favorable rates. This will lead to higher repayment costs in the long run.

- Mortgage Insurance Costs: Since there’s no deposit, you’ll likely need to pay for lender's mortgage insurance, adding to overall loan costs.

- Possibility of Negative Equity: If property values drop, you could find yourself owing more than your home is worth.

Navigating through the pros and cons lets you weigh your options better. This can help you decide if a zero deposit loan is right for you.

How to Apply for a Zero Deposit Loan

Applying for a zero deposit loan can be straightforward if you prepare thoroughly. Here’s a step-by-step guide to navigate the application process.

1. Gathering Documents

Begin by collecting necessary documents you’ll need for the application. This can include:

- Proof of Identity: Such as a driver’s license or passport.

- Employment Documentation: Pay slips, tax returns, and employment letters are crucial to verify your income.

- Bank Statements: Lenders often seek at least three months of statements to assess your savings and spending habits.

- Credit Report: Obtain your credit report to understand where you stand. You can access it for free from various credit reporting agencies.

2. Choosing a Lender

Research and select the right lender to suit your needs. Here’s how to streamline this step:

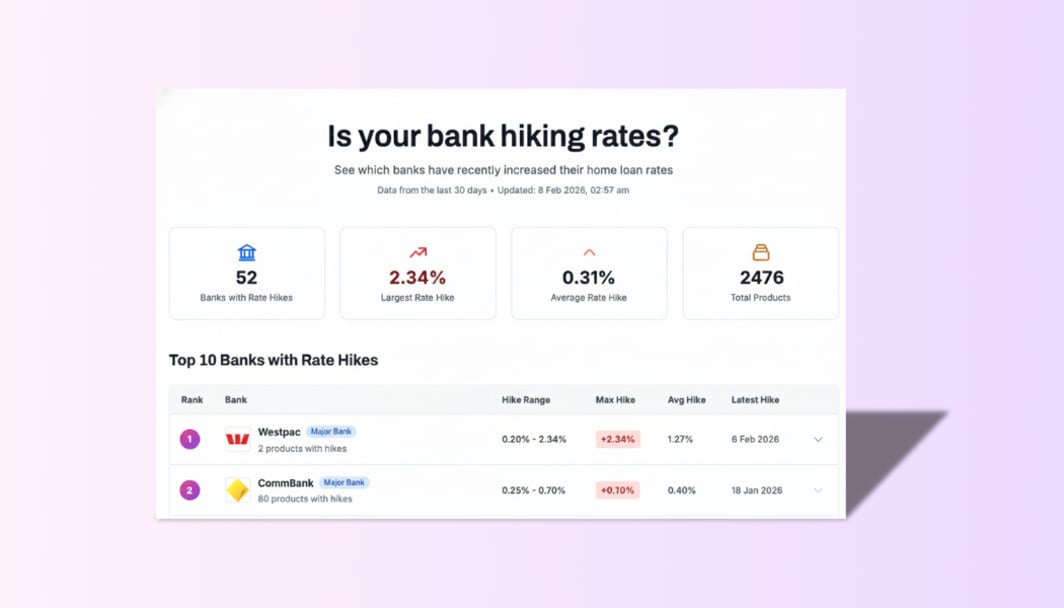

- Compare Rates: Use platforms like Bheja AI to compare various lenders and their offerings. This can save you time and ensure you secure a competitive rate.

- Check for Reviews: Look at user reviews to assess customer service quality and lending practices.

- Direct Inquiry: Don't hesitate to contact lenders directly to clarify any terms or conditions that may concern you. This helps build transparency and trust.

3. Understanding the Application Process

Once you’ve gathered your documents and selected a lender, you can initiate the application process:

- Complete the Application: Fill out the application carefully, providing accurate information. Incomplete applications can lead to delays.

- Submit Documents: Ensure all gathered documents are included in your submission. Missing documentation can stall the approval process.

- Await Approval: After submission, the lender will review your application. Be ready for them to contact you for additional information or clarification.

- Loan Offer: If successful, you’ll receive a loan offer detailing terms, conditions, and repayment schedules. Review this carefully before acceptance.

Resources to Explore

As you delve into zero deposit home loans, there are a few essential resources you can leverage for comprehensive information and guidance:

- Australian Securities and Investments Commission (ASIC): A great source for regulatory information and tips on managing your finances, including home loans.

- First Home Loan Deposit Scheme (FHLDS): This government initiative can provide significant assistance to first-time buyers looking to enter the market without substantial savings.

Using these resources can empower you to make informed decisions about your home finance journey.

Below is a comparative table to illustrate some key features of different loan types you might consider:

This overview allows you to easily distinguish your options and make the right choice according to your financial situation and goals.

Conclusion

Navigating the world of home loans can be tricky, but zero deposit loans can really help. Remember, these loans allow you to buy a home without a huge upfront cost, but they come with higher interest rates. It's crucial to check your eligibility and know what documents to prepare before applying.

At Bheja AI, we provide AI-driven insights to make your mortgage journey smoother. Compare 100+ brands, get proactive alerts, and make smarter financial decisions effortlessly. For more information, visit Bheja AI and take your first step toward homeownership!

Related Posts

Frequently Asked Questions (FAQs)

A zero deposit home loan is a type of mortgage that allows you to buy a home without needing to save for a deposit. Instead of paying a percentage of the home's price upfront, you can borrow the full amount.